On Nigerian streets, authors compete for space with imported used books, as books have left the shops to roadsides, where they are being strewn on street corners. With quality books, fairly used, and sometimes, pirated ones jostling for space on these pedestrian walkways and found spaces, publishers are still reeling under the yoke of high-interest rates, stringent government regulations and non-availability of raw materials writes GREGORY AUSTIN NWAKUNOR.

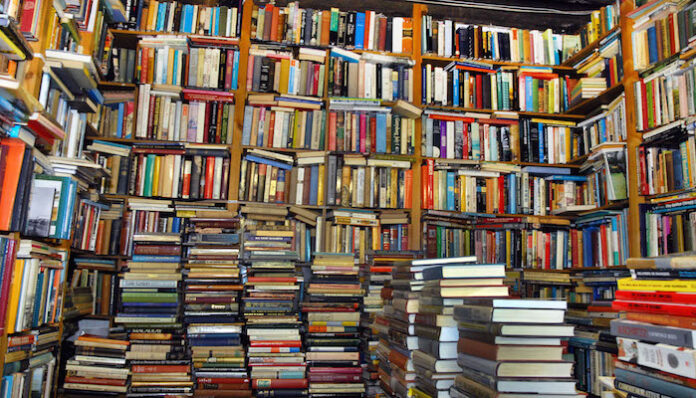

From piles of books that line sidewalks of Ikeja, Oshodi, and Ojuelegba areas of Lagos State, to stacked second-hand books in overloaded cardboard boxes in Onitsha, Anambra State, there are so much to read in Nigerian street shops- novels, memoirs, motivational, biographies and academic, there is no book that one cannot find on the streets.

The Nigerian indigenous publishing industry has experienced a downturn in the last two decades. Even though the country boasts several internationally renowned authors and celebrated writers, who have won international awards such as Chinua Achebe, Wole Soyinka, Amos Tutuola, John Pepper Clark, Femi Osofisan, Niyi Osundare, Odia Ofeimun and Chimamanda Ngozie Adichie, to name just a few, the country’s publishing sector is in comatose, groaning under the weight of high foreign exchange rate, poor patronage locally, rising production costs, and the import dependent situation of the sector.

Also making things worse in the sector are factors like inadequate infrastructure, non-payment of royalties, access to credit facilities, poor readership, poverty piracy etc.

Even as publishers are facing the challenge of rising inflation in the country and low purchasing power, demand for printing products, and their attendant effect on revenues and profits, the shift to digital media has made it easier for people to access books, magazines, and newspapers online, a development that has invariably led to a decline in print sales and a decrease in the number of physical bookstores.

Additionally, the rise of self-publishing and e-books has made it easier for authors to bypass traditional publishing houses and connect directly with readers. They have also largely taken over the niche formerly held by mass-market paperbacks — cheap, disposable books.

The rise of online retailers has equally impacted the industry, as they can offer books at a lower cost than traditional bookstores. These print-on-demand and online booksellers (mostly Amazon) have changed the entire distribution system and have made self-publishing (or “indie publishing,” as some call it) economically practical and sometimes even profitable for the first time since the last century.

Globally, the influence of new technology has altered the disposition of reading. Before now, schools engaged and participated in, reading activities to enhance the thinking and creative abilities of students. But the lack of availability of suitable reading materials, absence of well-designed reading activities, insufficiently trained staff to nurture and entrench reading culture in schools, and ineffective monitoring and evaluation of readership promotion programmes are constant challenges currently affecting readership development.

Ailing publishing industry

THE publishing industry is one of the sectors that is hard hit by the country’s economic crisis, but stakeholders in the book ecosystem still believe that all these could be turned around if the government implements the proposed National Book Policy. They said that the policy is key to reversing the trend.

Regrettably, despite an abundance of domestic raw materials, Nigeria spent N1.63 trillion on the importation of paper and its allied products in five years. Data obtained from the National Bureau of Statistics showed that the importation of paper and its allied products grew by 25 per cent to N412 billion in 2022.

A further breakdown showed that paper imports gulped up to N328.9 billion in 2021; N188.6 billion in 2020; N491 billion in 2019, and N214.3 billion in 2018.

The country spent N200 billion in 2017, N162 billion in 2016, and N151 billion in 2015 on the importation of paper. Undoubtedly, the huge sums spent on paper importation have had a big impact on the economy, especially as the three paper mills that were servicing that space closed shops at different times. They include the Nigeria National Paper Manufacturing Company Limited, Iwopin, Ogun State, which produced Bond paper; Nigeria Paper Mills, Jebba, Kwara State produced Kraft paper, and the Nigeria Newsprint Manufacturing Company Limited (NNMC), Oku-Iboku, in Akwa Ibom State produced newsprint.

Among other things, the mills were established to bring down the cost of educational books, produce newsprint, and Kraft paper, and curb the importation of papers, for local consumption, which had neighbouring countries benefitting from it, as they flock to Nigeria (Shomolu – a printing hub in Lagos) to carry out their printing works.

The older mills performed optimally in the 1960s and 1970s as a result of high capacity utilisation. By 1985 and 1986, capacity utilisation in the Nigerian Paper Mill, which was 62.3 per cent in the 1960s had risen to 66.17 per cent.

However, in 1996, the NNMC in Oku-Iboku, stopped production, leading to complete dependence on importation of paper and paper products. In 2006, the mills were privatised, and, currently more than a trillion naira is expended on the importation of paper products, and over two million metric tonnes of paper’s worth are imported yearly.

Over the years, several publishing firms have made their marks in the country, both the indigenous, and erstwhile foreign ones, which of course, have also become indigenous (owing to the Indigenisation Policy of 1978). They include Longman Plc, now Learn Africa Plc., Macmillan Publishers Limited, Evans Brothers Publishers Limited, Spectrum Books Publishers Limited, Heinemann Educational Books Plc., and University Press Plc.

The weak corporate earnings by these companies come on the heels of an increase in the cost of sales and administrative expenses, as most companies operating in the country have to contend with hikes in production materials and foreign exchange.

Academy Press, University Press, and Learn Africa also experienced a 32.88 per cent decline in profit during the first quarter of 2023, while its profit dipped from N783.8 million in the same quarter of 2022 to N559.8 million.

The analysis of Q1’23 financial statements showed an increase in operating expenses within the publishing industry, as operating expenses such as marketing, distribution, and administrative expenses, grew by an average of 14 per cent across the sector.

This upward trend can be attributed to factors like inflation, higher production costs, and investments in digital infrastructure. Operating expenses in the first quarter of 2023 amounted to N3.14 billion from N2.75 billion recorded in the same quarter of 2022.

In the first quarter of 2023, the Nigerian publishing industry recorded marginal growth in revenue of 0.25 per cent to N10.14 billion from N10.11 billion recorded in the same quarter of 2022.

The industry as a whole saw a modest increase in sales compared to the same period in the previous year. A look at the performance of companies in the printing/publishing sector revealed that they have not had a successful run in the bourse for almost half a decade. For instance, Academy Press’ results for the first quarter, which ended June 2018 showed that revenue dipped from N606 million in 2017 to N457 million in 2018. The company’s loss before tax stood at N91 million in 2018, as against N4.2 million posted in 2017.

Also, the company’s results for the half-year ended September 30, 2018, showed that revenue dipped from N1.2 billion in 2017 to N1.1 billion in 2018. The firm made a loss before tax of N85.1 million in 2018, as against a loss before tax of N4.3 million recorded in 2017.

The company’s revenue, however, grew by 11.46 per cent to N2.43 billion in 2019, from N2.18 billion in the previous year, while profit before tax grew by 112.9 per cent to N1.324 million from a loss of N10.27 million recorded in the previous year.

Despite the slight increase in revenue, the company recorded a loss after taxation of N47.945 million from a profit of N34.693 million in 2019.

The company’s audited financial statements for the year ended March 31, 2020, showed a 0.28 per cent rise in revenue at N2.440 billion, from N2.433 billion in 2019.

Also, the University Press Plc., reported a 55 per cent drop in its full-year ended March 31, 2021, audited result, and accounts and proposed a dividend of N0.05.

The company’s profit closed the 2021 financial year at N57.11 million, from N127.2 million reported in 2020 as profit before tax also dropped by 57.7 per cent to N75.29 million in 2021 from N178.06 million in 2020.

Investigations revealed that 31.3 per cent and 42.04 per cent drop in revenue and finance income impacted profits reported by the University Press in the 2021 financial year.

The company reported N1.42 billion in revenue in 2021, from N2.07 billion in 2020, while finance income moved from N25.84 million to N14.97 million in 2020.

Cost of publishing books

THE founder of Abuja Writers Forum, Emman Shehu, and a novelist, Ejiro Otive-Igbuzor, at the July Guest Writer Session in Abuja, noted that the cost of publishing books in the country was negatively affecting those in the business of writing.

Consequently, the Chairman of the Nigerian Book Fair Trust, Dare Oluwatuyi, called for a favourable government policy for the books sub-sector to thrive.

According to him: “The cost of forex is still very high and we are not able to pass that cost to consumers. Even when getting stock material, the working capital is enormous, you need to have a lot of cash to do good business and the banks are not giving loans, even when they lend, it is so expensive that you find it very difficult to pay back.”

The increasingly high cost of foreign exchange (forex) about the naira constitutes a threat to a wide range of industries, including packaging, entertainment/events, education, print media, etc.

While fingering policy somersault as a major problem in the industry’s growth, and manufacturing sector as a whole, the Managing Director/CEO of FAE Limited, the largest envelope manufacturing company in Nigeria, Princess Funlayo Bakare-Okeowo, said that “if there is stable policy, the industry will thrive.”

She added that the government should invest in the industry, stressing that if the country makes papers, the turnover of stakeholders would be high. “Let us have a paper research institute that will help to research different areas that papers could be made. We can get together and form clusters to make papers. It’s a law of supply and demand. The demand for forex is more than its supply; if we produce locally and save our forex there will be equilibrium.”

Bakare-Okeowo continued: “We spend almost $5 billion yearly on importing paper into this country. Why should we be doing that, yet we say we don’t have foreign exchange? These are the drainpipe areas that our dollars are going into. Imagine $5 billion in Nigeria’s coffers. It would go a long way. So, we can save our foreign exchange by producing things that we can produce here. That is for the government.”

Speaking at the recent unveiling of The Fine Art Of Bookselling: Reflections of Nigeria’s Industry Stakeholders by Dare Oluwatuyi, she regretted that the government is yet to see the paper industry as a gold mine. “But paper making is like oil. For example, a ton of white paper now is about $1,200. When you look at Egypt, for example, you can see the population of that country with Nigeria. Egypt has 25 paper mills….”

She continued: “That is why we, the stakeholders in the paper industry are calling for a functional paper mill in the country. Having a paper research institute too will bring enough revenue to the government. Already, operators are suggesting new species of trees to increase access to raw materials.

“When we look at it, gone are the days when people would need to plant Gmelina trees to grow for 12 years before being used for the production of paper. Nobody is ready to invest for 12 years before seeing a return on investment. The gestation period is too long. Therefore, researchers have researched that Kenaf, in which we have high deposits in the North can come in as a reasonable substitute. Kenaf has a gestation period of six months. So, our problem is over when it comes to raw materials. Our jute leaves (ewedu) can also be used as raw material to make paper,” Bakare-Okeowo said,

At the 22nd Nigeria International Book Fair in Lagos, in May, stakeholders also observed that the book industry in the country is currently suffocating and in dire need of a saviour.

Some publishers who spoke at the event said that it has not been easy for the local industry, stressing that the only way to help the sector is for the government to revive the country’s paper mills; encourage local production, give them incentives, and reduce the cost of diesel.

A former Deputy Provost of Adeniran Ogunsanya College of Education, Otto-Ijanikin, who is a writer, Dr. Femi Adedina, urged the government to prioritise resuscitating the moribund paper mills or support the establishment of new paper mills, a development that he said will tremendously reduce the dependence on importation for raw materials.

Much as the resuscitating of the comatose paper mills will be a good step in the right direction, the full capacity of the three paper mills is not up to 200, 000 metric tons. At the moment, Nigeria uses over three million metric tons yearly. This, therefore makes importation of raw materials inevitable.