- The NIN is now the TIN for individual taxpayers, while the CAC registration number is the TIN for enterprises and corporate bodies

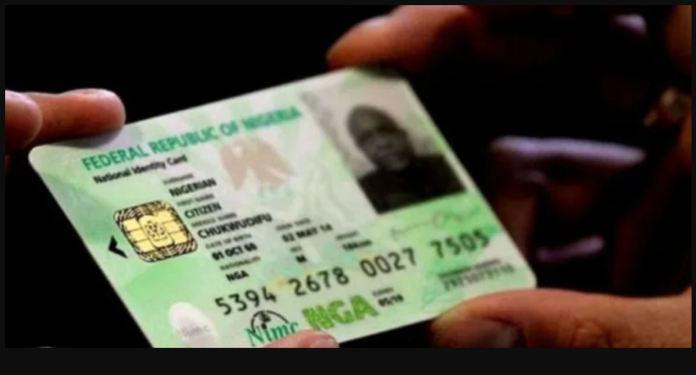

Federal Inland Revenue Service (FIRS) has announced that the National Identification Number (NIN) will now serve as the permanent Tax Identification Number (TIN) for individuals, signaling a major shift in the country’s tax administration.

The agency also confirmed that for corporate entities, the registration number issued by the Corporate Affairs Commission (CAC) will function as their official tax identifier.

In a statement released Monday, the FIRS characterized the move as a strategic effort to simplify tax compliance and broaden the national tax base through the integration of existing biometric data.

”The NIN is now the TIN for individual taxpayers, while the CAC registration number is the TIN for enterprises and corporate bodies,” the revenue agency stated, adding that the policy is designed to eliminate the need for taxpayers to undergo multiple registration processes.

The initiative follows recent legislative adjustments aimed at modernizing Nigeria’s fiscal framework. By leveraging the National Identity Management Commission (NIMC) database, the government intends to automatically capture eligible taxpayers who were previously outside the formal tax net.

The FIRS emphasized that this “seamless integration” would reduce administrative bottlenecks for both the government and the public.

”This development is part of our commitment to making tax payment easier and more efficient. With this integration, taxpayers do not need to visit our offices to apply for a separate TIN,” the statement added.

Financial experts suggest that using the NIN for taxation purposes will significantly improve the government’s ability to track income and assets, potentially curbing tax evasion in Africa’s largest economy.

However, the transition has raised questions regarding data privacy and the readiness of digital infrastructure to handle the influx of synchronized records.

The FIRS urged citizens and business owners to ensure their records with NIMC and the CAC are up to date to avoid discrepancies in their tax profiles. The agency noted that existing TINs would remain valid during a transition period, though the NIN and CAC numbers are now the primary legal identifiers for all future tax-related transactions.